ValueChecker: True Straight-Through-Processing thanks to automated product appraisals

Written by Roger Peverelli and Reggy de Feniks – Founders The DIA Community on Feb 2, 2024

One of the big challenges of an automated content claim process is determining the value of what was claimed, and getting it replaced at the best price and fast. The valuation of product damages is often done manually by claim handlers and therefore labor intensive, slow, subjective, and expensive.

ValueChecker’s product technology helps insurers automate their claims process. Available in Europe, the USA, and Australia, the ValueChecker solution identifies the claimed product and calculates the best replacement product and valuation in real-time. ValueChecker automates the process of product appraisal, reducing manual work, valuation errors, and subjectivity. ValueChecker clients save over 20% in settlement costs, can automate over 80% of claims, and improve NPS scores by more than 20 points.

How it works

ValueChecker was developed from sister company alaTest’s 17 years of global product comparison technology. Their extensive product database, combined with online sources and search technology, enables ValueChecker to automatically appraise a far greater percentage of product claims, at a lower settlement cost and higher customer satisfaction.

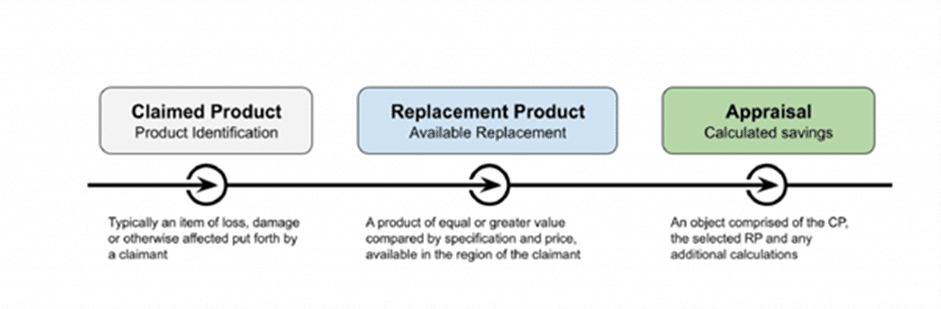

The ValueChecker claims process is divided into four different stages. The first one is the Claimed Product Identification. This means that the claimed product is identified using ValueChecker’s extensive database, online data sources, customized Google search engines, and algorithms. After this Availability / Replacement product identification comes into play. At this stage, market availability is scanned in real-time. Should the claimed product be out of stock or discontinued, ValueChecker automatically identifies the best like-for-like replacement product. The third stage is Valuation/Actual Cash value calculation. This is settlement valuation based on real-time pricing data to identify replacement cost, and automatically apply depreciation/excess rules for a final settlement calculation. This leads to the final stage: Settlement. Final settlement of the claim is made via repair partners, cash payment, voucher delivery, or delivery in kind, directly from within ValueChecker.

Why we selected ValueChecker for ITC DIA Europe

Claims handling will always be the moment of truth for insurers. Automation has proven to work well in terms of speeding up and simplifying the claims process. ValueChecker taps into this need and its solution adds to the full automation of claims handling.

At ITC DIA Europe Munich, Arie Struik, Founder & CEO at ValueChecker, and Willem van de Hooft, Co-Founder & BusinessDevelopment, took the stage to demonstrate ValueChecker’s proprietary tool that helps insurance claims handlers quickly and accurately determine the fair claim values of damaged products.

Who is ValueChecker?

ValueChecker was born out of the global product comparison company alaTest, founded in 2005 by Arie Struik. After friend-since-the-cradle Willem van der Hooft joined as an investor he suggested that alaTest could solve a major problem for the insurance industry, the process of fair product appraisals. This started the ValueChecker project in 2017. The current team is around 20 people strong with its HQ in Stockholm and an office in The Gambia. Expansion to the USA is ongoing in 2023 and 2024.

Original article source: ITC DIA Europe